Special Update: Iran and Long-Term Investing

As you have seen in the news, the U.S. and Israel have launched military strikes against Iran, targeting its leadership, military assets, and nuclear infrastructure. Iran’s Supreme Leader is confirmed to have been killed, and Iran has retaliated with missile and drone attacks across the Middle East. President Trump has stated that the goal of […]

Supreme Court Tariff Ruling: Key Takeaways for Investors

After nearly a year of trade policy uncertainty, the Supreme Court’s ruling that recent tariffs are unconstitutional has reset the policy landscape. Yet, as is often the case in Washington, when one chapter closes, another opens. President Trump has already signaled a switch to an alternative legal framework for tariffs, and markets are still digesting […]

Jobs, Inflation, and Growth: Is the Economy Healthy?

The health of the economy is important to long-term investors because it drives their portfolios and their financial plans. Recent economic data points have sent mixed signals, leaving some investors unsure of what to make of the current environment. However, just as a doctor doesn’t diagnose a patient based on a single number, investors should […]

How Equity Compensation Fits into Your Financial Plan

For many professionals today, equity compensation is not just a nice perk, but a significant source of wealth accumulation over their careers. Whether through restricted stock units (RSUs), stock options, or other forms of company equity, these awards have become increasingly common across industries and job levels. However, with this type of compensation comes complexity. […]

Can Owning Your Own Financial Services Firm Make You More Ethical?

There are a lot of reasons people decide to leave corporate and break out on their own. One of the most common reasons, regardless of industry, is the fact that the corporate world tends to reduce everything and everyone to numbers on a balance sheet. How much revenue is this person bringing in? How much […]

Is AI Eating the World? A Portfolio Perspective

Fifteen years ago, venture capitalist Marc Andreessen famously wrote that “software is eating the world.” What he meant was that any service that could be written and automated as software, would be. This has proved accurate as cloud computing, software-as-a-service, and digital platforms have reshaped both entire industries and how consumers buy goods and services. […]

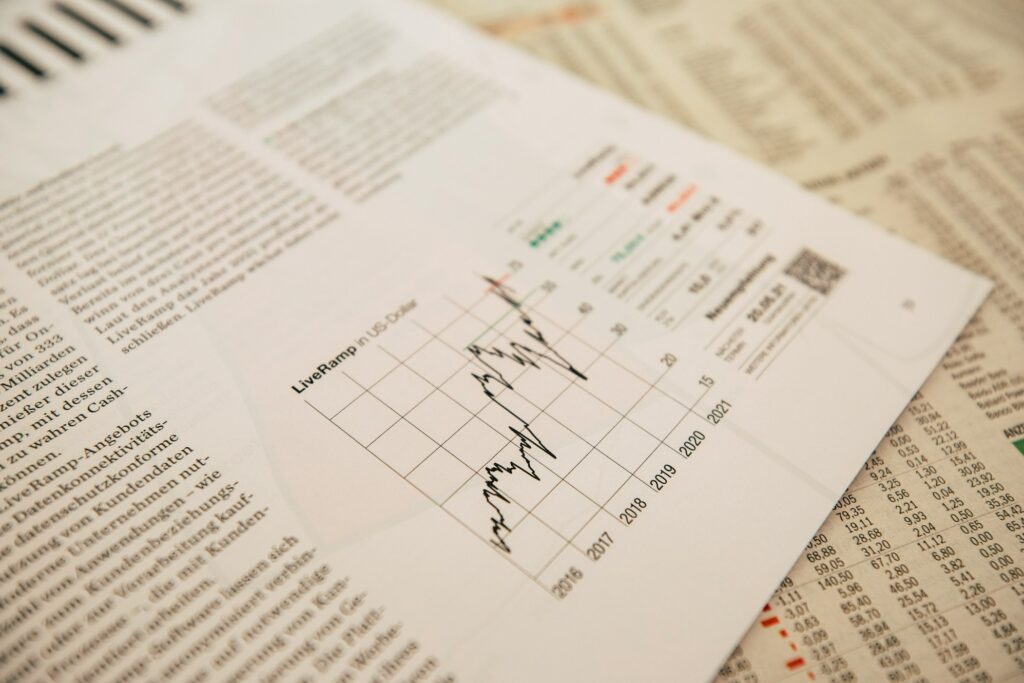

Monthly Market Update for January: Geopolitics, the Fed, and Precious Metals

The start of the year was positive for stocks and bonds, continuing the rally from recent years. This might be surprising to some investors since there were several periods of volatility driven by geopolitics and Federal Reserve policy. While headlines created short-term swings, including the S&P 500’s worst day since last October, markets rebounded quickly. […]

The Importance of Earnings for Long-Term Portfolios

As the corporate earnings season ramps up, markets are shifting their focus from geopolitical concerns to tangible evidence of how businesses are performing. With the stock market hovering near all-time highs, questions around valuations and the sustainability of recent profitability trends have become increasingly important. While it’s still early in the reporting season, current Wall […]

Gold and Silver: Current Portfolio Perspectives

Gold, silver, and other precious metals have rallied over the past two years, capturing investor attention. Gold recently surpassed $4,700 per ounce while silver now trades above $90 per ounce, marking historic milestones for both metals. This strong recent performance may lead some investors to wonder whether they should be investing in these assets. As […]

Special Update: Venezuela, Oil, and the Impact on Portfolios

The arrest of Venezuelan President Nicolás Maduro by U.S. forces represents an unexpected and significant geopolitical event. As has been widely reported, the U.S. military successfully conducted an operation that detained Maduro on charges related to drug trafficking and corruption. President Trump stated in a press conference that the United States will “run” Venezuela and […]